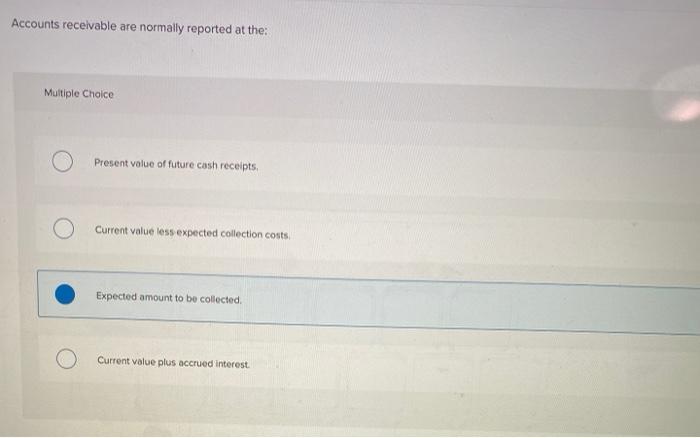

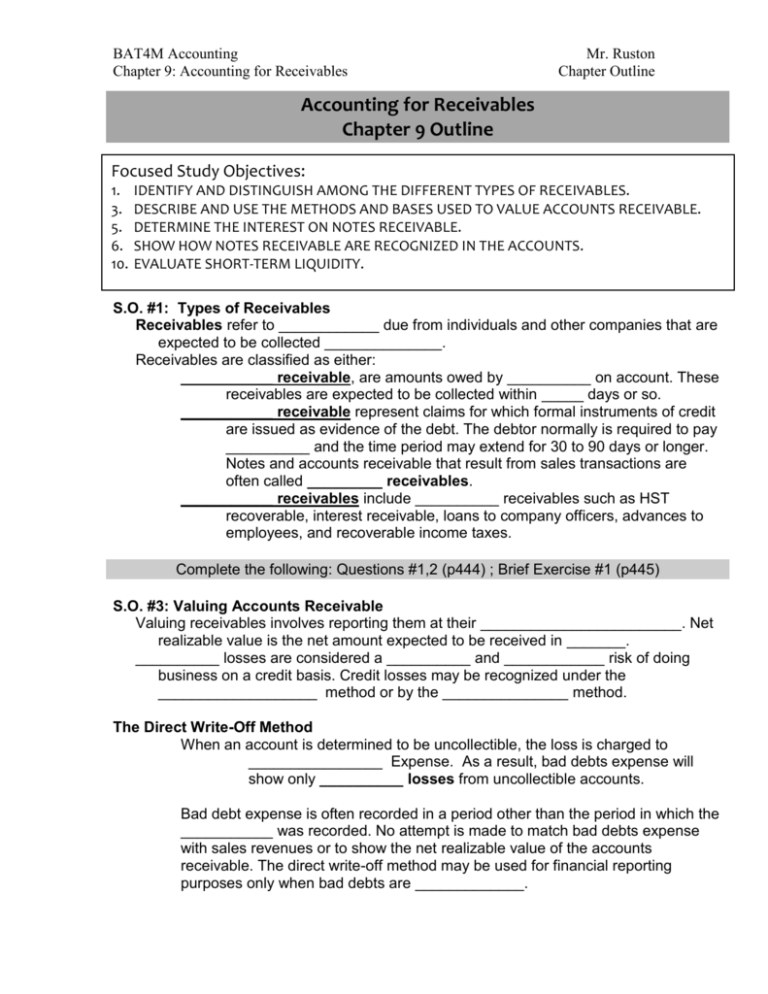

Accounts Receivable Are Normally Reported at the:

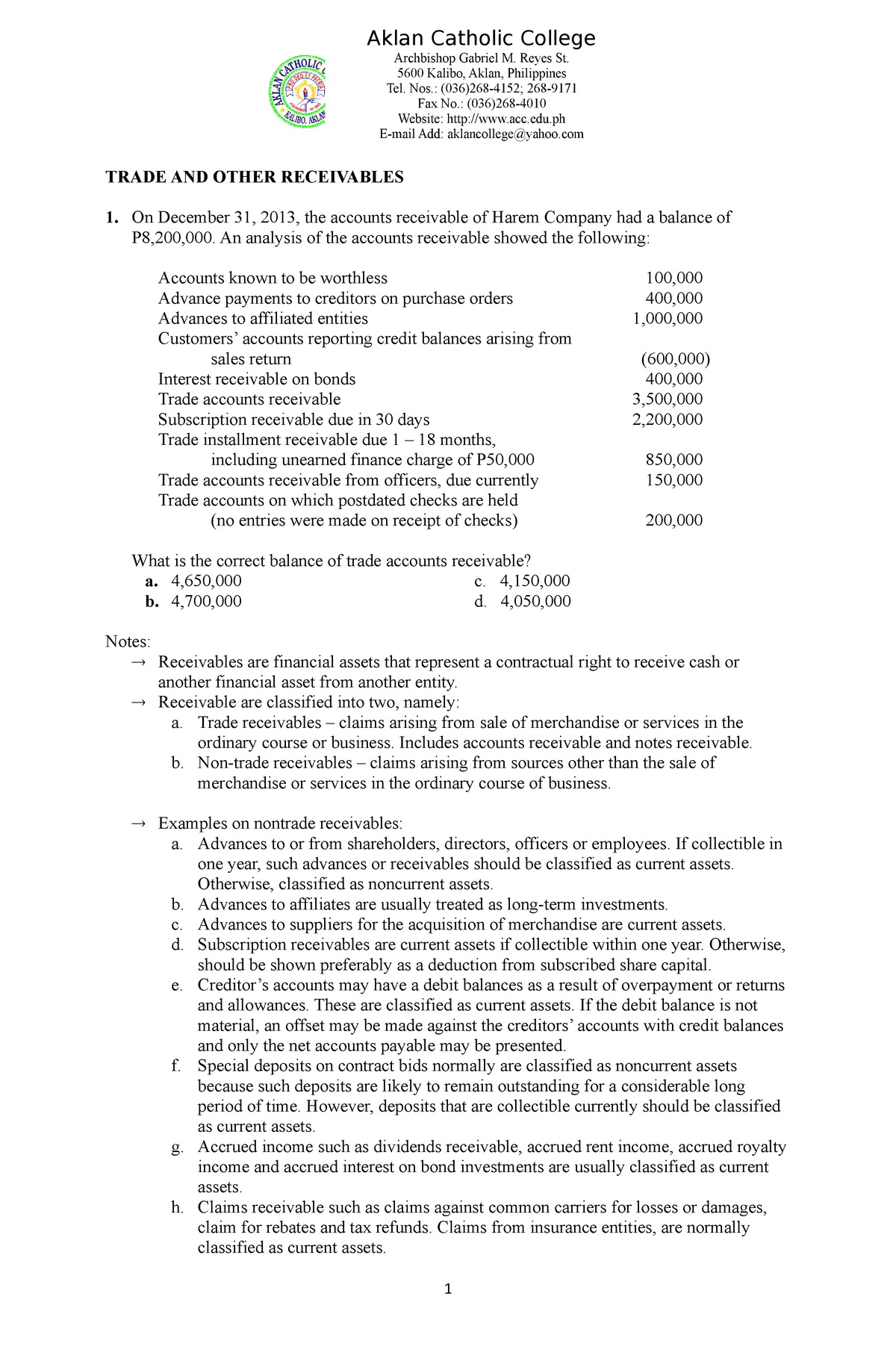

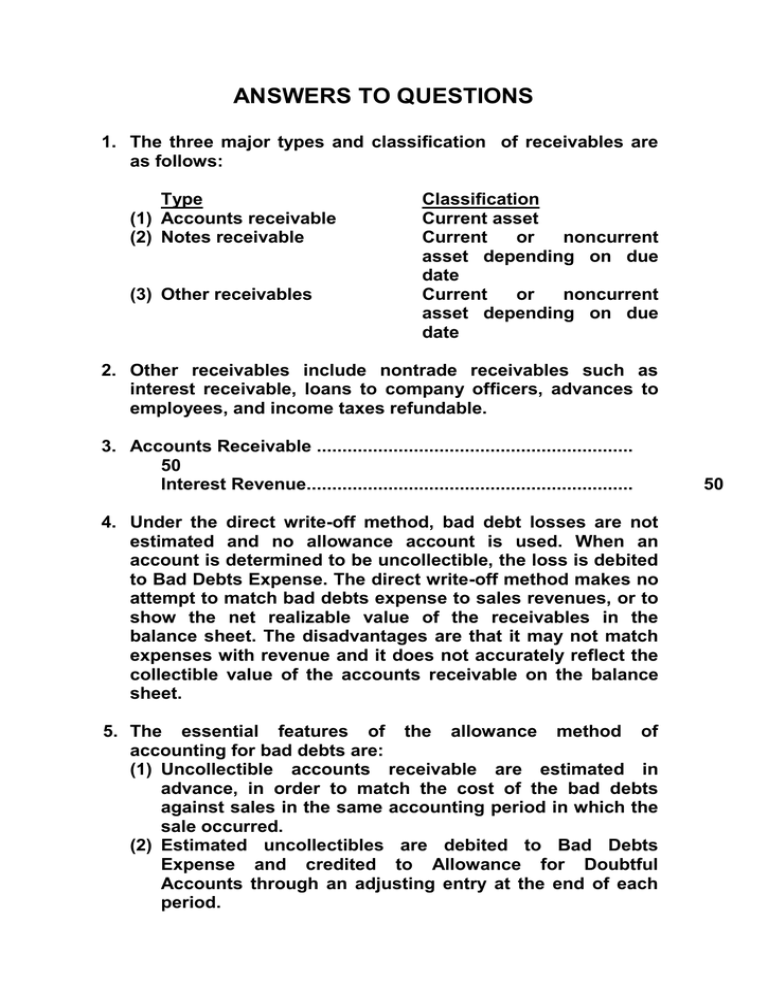

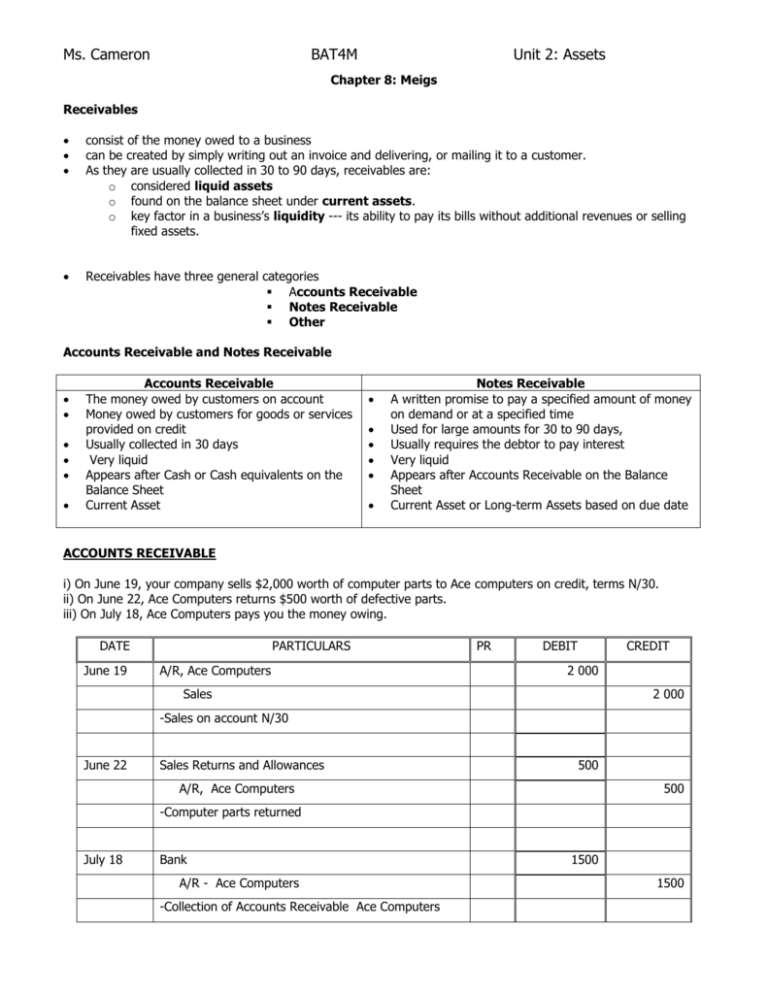

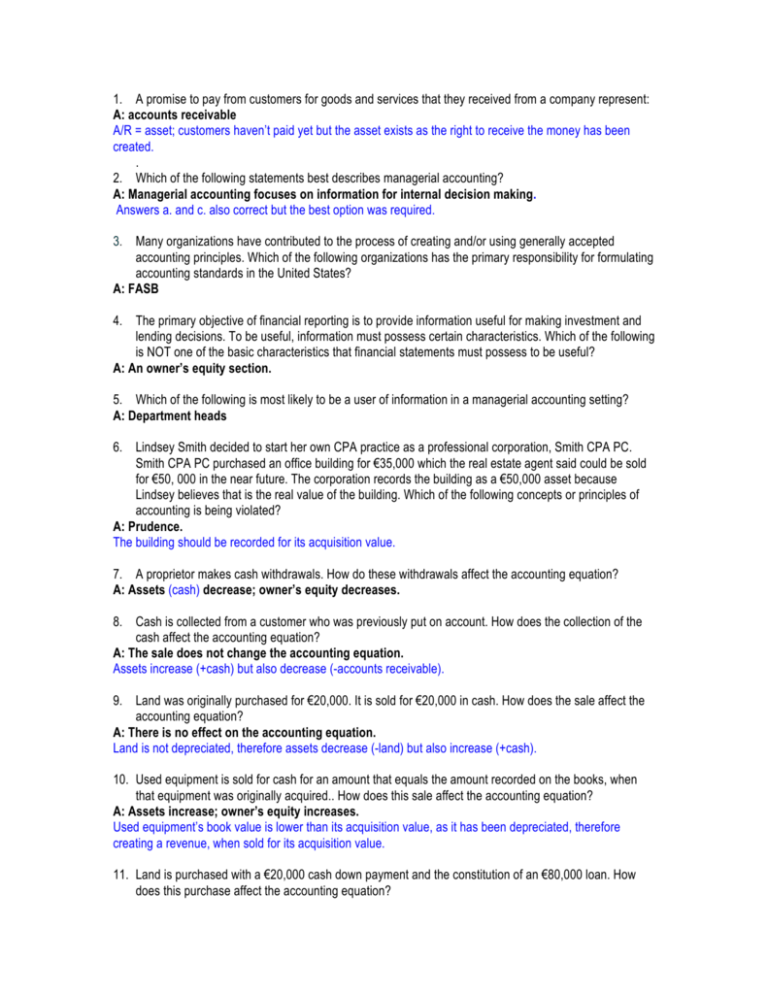

On May 1 received a P300000 six months 12 int note from MN in settlement of the account b. Accounts receivable or receivables represent a line of credit extended by a company and normally have terms that require payments due within a relatively short time period.

Accounts Receivable Aging Report Excel Template Platform Sh Product Analysis Report Template Sample Product Competitive Analysis Analysis Competitor Analysis

Current value plus accrued interest c.

. The report is usually divided into intervals such as 0-15 days 15-30 days 30-45 days and more than 45 days. An accounts receivable AR aging report organizes all your unpaid customer invoices based on how long they have been outstanding. Open the invoice then click Receive Payments.

Accounts receivable overview Accounts receivable is recorded on a businesss balance sheet as a current asset as it is a promise for payment for goods or services that you provided your customer. An asset account used to record a loan by one fund to another fund in the same governmental unit. It is then sorted into columns.

The accounts receivable aging report will list each clients outstanding balance. Lets go over to the expenses charged to jobs. Select the deposit then click Done.

This should keep both AR account and Undeposited Funds accurate. Bad debt expenses can also be reported on income statements for several years after the sale. It is recommended that.

AR includes payments for goods and services rendered by a business on specific credit terms. The Accounts Receivable Aging Report. The difference between Accounts Receivable and its contra asset account is called net realizable value.

Expected amount to be received. This money is typically collected after a few weeks and is recorded as an asset on your companys balance sheet. If it is impracti cable or impossible to use confirmation procedures alternative procedures may be performed.

Although Allowance for Doubtful Accounts normally has a credit balance it may have either a debit or a credit balance before adjusting entries are recorded at the end of the accounting period. Current value less expected collection cost d. Accounts receivable abbreviated as AR or AR are legally enforceable claims for payment held by a business for goods supplied or services rendered that customers have ordered but not paid for.

Every report run within an AP system is typically time-sensitive. It typically ranges. Click Apply Credits then go to the Credits tab.

The account is shown on the balance sheet as a deduction from the taxes receivable account to arrive at the net taxes receivable. The lower the percentage the better. Open the deposit then change the account to Accounts Receivable.

Accounts payable reporting is the ongoing process of tracking and recording all business expenditures by a company big or small to ensure accurate financial data. These are generally in the form of invoices raised by a business and delivered to the customer for payment within an agreed time frame. Accounts Receivable should normally be reported at.

You use accounts receivable as part of accrual basis accounting. Accounts receivable consists of monies due from customers as a result of an organizations normal business operations. The term accounts receivable is the financial account a company uses to keep tabs on credit owed by customers and when it gets paid.

The Accounts Receivable Aging Report indicates how long insurance claims and patient balances have been outstanding and are represented as a percentage over 120 days. The frequency at which you send invoices typically dictates the frequency at which you will receive payment. Expected amount to be received.

Expected amount to be collected Current value plus accrued interest. Monitoring receivables with this report helps business owners identify. This system also implies that anticipated payments are legally binding and enforceable.

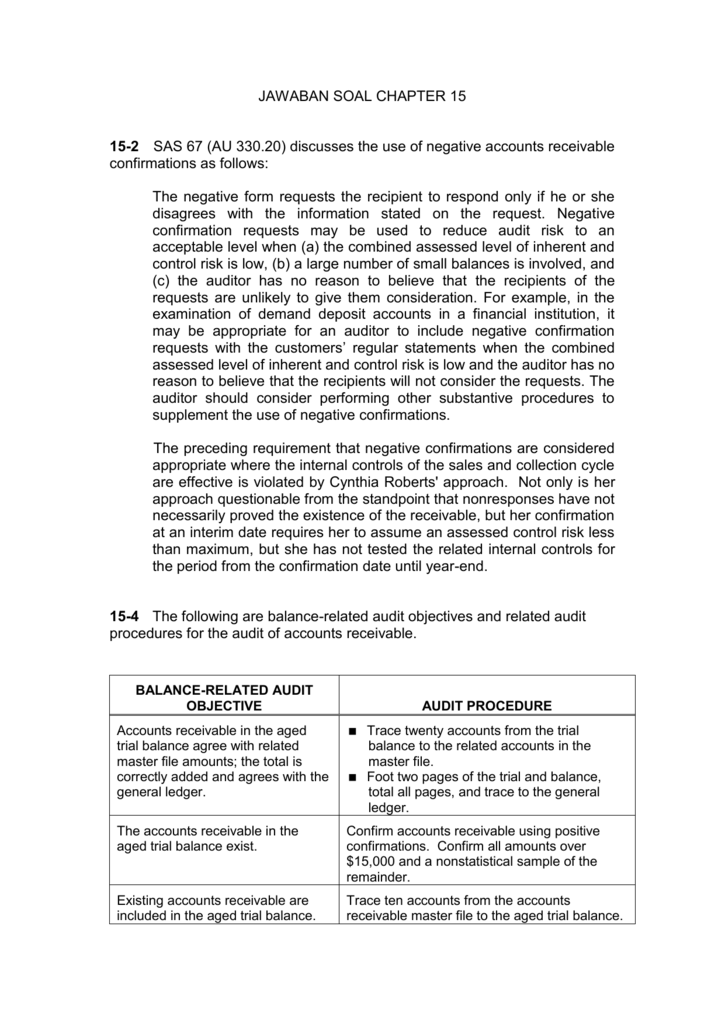

Separate accounts may be maintained on the basis of tax roll year delinquent taxes or both. At the end of a period before the. Accounts receivable aging tabulated via an aged receivables report is a periodic report that categorizes a companys accounts receivable according to the length of time an invoice has been.

Click Save Close. Its represented in both a dollar amount as well as a percentage. The balance in account receivables is reported as current assets on the balance sheets.

In an accounting system Accounts Receivable is recorded on the balance sheet as an asset of the company issuing the good or service. On June 30 factored P400000 of its accounts receivable in a finance com. Accounts payable reports cover cash expenses mortgage or rent utility payments and the overall cost of doing business.

A Complete Guide to Accounts Receivable AR Aging Reports. The accounts receivable is the amount owed by the customer to the company. Accounts receivable is shown in a balance sheet as an.

Accounts receivable are normally reported at the. Prior to 1939 confirmation of accounts receivable was not normally per formed. Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past.

This allows them to collect these bills as soon as possible to move the money into the bank account. It is the current asset of the company and reported in the asset section of the balance sheet. Current value less expected collection costs.

Purple Co showed the following balances as of Dec 31 2021 Account receivable P2000000 All for doubtful accounts 60000 The ff transactions transpired during the year a. Resultantly the balance sheet may report a greater amount than what is to be collected. Any activity or entries made into the account are called.

It is reported as a net realizable value which is the expected amount to be received from the customers. Present value of future cash receipts b. The management of accounts receivable is an extremely important function since the collection of outstanding receivables represents the single most important source of cash for all organizations selling goods on open account.

Which accounts receivable are material independent auditors normally confirm receivables by direct communication with debtors. Multiple Choice Present value of future cash receipts. To identify the average age of receivables and identify potential losses from clients businesses regularly prepare the accounts receivable aging report.

Click Save Close.

What Is Accounts Receivables Examples Process Importance Tally Solutions

Is Account Receivable An Asset Or Liability Explanation And Examples

Receivables Summary About How We Can Deep Understanding About Studocu

Pin By Hoshimi On Notes Accounts Receivable Business Finance Accounting

Solved Accounts Receivable Are Normally Reported At The Chegg Com

Oracle Account Conciliation Scenarios Unidentified Receipts Accounts Receivable Accounting Receipts

Regions Bank Statement Template Regions Bank Personal Financial Statement Forms Statement Template Personal Financial Statement Bank Statement

Trend Analysis Report Template 6 Templates Example Templates Example Trend Analysis Report Template Accounts Receivable

Cars Of Bob S Burgers In 2022 Reliable Cars Family Car Car Guys

3 Types Of Accounts Receivable And Their Meanings You Should Know News Tips

Awesome Cost Effectiveness Analysis Template In 2021 Balance Sheet Reconciliation Meeting Agenda Template Agenda Template

Comments

Post a Comment